“CEO Jessica Huyen Do attended an event hosted by the U.S. Embassy in Hanoi, where the SelectUSA Summit—a premier annual conference held in Washington, DC and organized by VINASA—was introduced.”

U.S. EB-5 IMMIGRANT INVESTOR PROGRAM

The U.S. Congress established the EB-5 program in 1990 to boost the American economy by creating additional jobs. EB-5 stands for “Employment-Based Fifth Preference.” This is an immigration program allowing foreign investors to invest in U.S. commercial projects in exchange for green cards for themselves and their families.

WHY CHOOSE THE U.S. EB-5 IMMIGRANT INVESTOR PROGRAM ?

The EB-5 Program offers a SAFE and fast pathway for you and your family to obtain U.S. green cards, enjoy a high quality of life, and build a bright future. Join us in exploring the top-tier benefits of EB-5: gaining permanent residency and the opportunity to acquire U.S. citizenship.

There are four U.S. employment-based immigrant visa categories, classified by priority level:

- EB-1: For individuals with extraordinary abilities, such as renowned scientists, artists, and entrepreneurs.

- EB-2: For individuals with advanced degrees or exceptional skills and relevant work experience.

- EB-3: For skilled workers with professional experience, sponsored by a U.S. employer.

- EB-5: For foreign investors.

The EB-5 Immigrant Investor Program is governed by several key legal frameworks:

- Immigration and Nationality Act (INA): The primary legal basis for the EB-5 Program is found in the Immigration and Nationality Act, specifically in Section 203(b)(5), which outlines the provisions for employment-based immigrant visas for investors.

- Title VI of the Immigration Act of 1990: This legislation established the EB-5 Program to stimulate the U.S. economy through foreign investment.

- Regional Center Program: Introduced by the Immigration Act of 1990 and further defined by subsequent regulations, this program allows investors to qualify for EB-5 visas by investing in projects managed by USCIS-approved regional centers.

- 8 CFR § 204.6: The Code of Federal Regulations, Title 8, Section 204.6, provides the detailed regulations governing the EB-5 Program, including the requirements for investment, job creation, and the approval process for regional centers.

These legal frameworks collectively establish and regulate the EB-5 Program, ensuring that it meets its economic goals while providing a pathway for investors to obtain U.S. permanent residency.

For more official information, please refer to the U.S. Citizenship and Immigration Services website at the following link:

https://www.uscis.gov/working-in-the-united-states/permanent-workers/eb-5-immigrant-investor-program

The EB-5 Immigrant Investor Program was first introduced as a pilot program in 1992 and has since been extended several times. Foreign investors can qualify for an EB-5 visa by investing through USCIS-designated regional centers to stimulate economic growth.

On March 15, 2022, President Biden signed the EB-5 Reform and Integrity Act, which introduced new requirements for the EB-5 visa and the Regional Center Program, with authorization extended through September 30, 2027.

EB-5 Investment Requirements:

The investor must invest in a new commercial enterprise:

- Established after November 29, 1990; or

- Before or on November 29, 1990, provided the enterprise is restructured or expanded through investment to increase its net worth or number of employees by at least 40%.

A new commercial enterprise can include any for-profit activity such as:

- Sole proprietorships

- Partnerships (limited or general)

- Parent companies and wholly owned subsidiaries

- Joint ventures

- Corporations

- Business trusts

- Limited Liability Companies (LLCs)

- Other entities, whether public or private

Non-commercial activities, such as owning and operating personal residences, do not qualify as new commercial enterprises.

For more official information, please refer to the U.S. Citizenship and Immigration Services website at the following link:

An EB-5 investor must invest the required amount of capital in a new commercial enterprise that will create full-time positions for at least 10 qualifying employees.

- For a new commercial enterprise not located within a regional center, the new commercial enterprise must directly create the full-time positions to be counted. This means that the new commercial enterprise (or its wholly owned subsidiaries) must itself be the employer of the qualifying employees.

- For a new commercial enterprise located within a regional center, the new commercial enterprise can directly or indirectly create the full-time positions. Up to 90% of the job creation requirement for regional center investors may be met using indirect jobs.

- Direct jobs establish an employer-employee relationship between the new commercial enterprise and the persons it employs.

- Indirect jobs are held outside of the new commercial enterprise but are created as a result of the new commercial enterprise.

- In the case of a troubled business, the EB-5 investor may rely on job maintenance.

- The investor must show that the number of existing employees is, or will be, no less than the pre-investment level for a period of at least two years.

A troubled business is one that has been in existence for at least two years and has incurred a net loss during the 12- or 24-month period before the priority date on the immigrant investor’s Form I-526. The loss for this period must be at least 20% of the troubled business’ net worth before the loss. When determining whether the troubled business has been in existence for two years, USCIS will consider successors in interest to the troubled business when evaluating whether they have been in existence for the same period of time as the business they succeeded.

A qualifying employee is a U.S. citizen, lawful permanent resident, or other immigrant authorized to work in the United States, including a conditional resident, temporary resident, asylee, refugee, or a person residing in the United States under suspension of deportation. This definition does not include immigrant investors; their spouses, sons, or daughters; or any noncitizen in any nonimmigrant status (such as an H-1B nonimmigrant) or who is not authorized to work in the United States.

Full-time employment means employment of a qualifying employee by the new commercial enterprise in a position that requires a minimum of 35 working hours per week. In the case of the regional center program, full-time employment also means employment of a qualifying employee in a position that has been created indirectly that requires a minimum of 35 working hours per week.

A job-sharing arrangement where two or more qualifying employees share a full-time position will count as full-time employment provided the hourly requirement per week is met. This definition does not include combinations of part-time positions even if, when combined, the positions meet the hourly requirement per week.

Jobs that are intermittent, temporary, seasonal, or transient do not qualify as permanent full-time jobs. However, jobs that are expected to last at least two years are generally not considered intermittent, temporary, seasonal, or transient.

For more information, please go to the link below:

https://www.uscis.gov/working-in-the-united-states/permanent-workers/employment-based-immigration-fifth-preference-eb-5/about-the-eb-5-visa-classification

Capital means cash and all real, personal, or mixed tangible assets owned and controlled by the immigrant investor. All capital will be valued at fair-market value in U.S. dollars.

The definition of capital does not include:

- Assets acquired, directly or indirectly, by unlawful means (such as criminal activities);

- Capital invested in exchange for a note, bond, convertible debt, obligation, or any other debt arrangement between the immigrant investor and the new commercial enterprise;

- Capital invested with a guaranteed rate of return on the amount invested; or

- Capital invested that is subject to any agreement between the immigrant investor and the new commercial enterprise that provides the immigrant investor with a contractual right to repayment, except that the new commercial enterprise may have a buy back option that may be exercised solely at the discretion of the new commercial enterprise.

Note: Immigrant investors must establish that they are the legal owner of the capital invested. Capital can include their promise to pay (a promissory note) in certain circumstances.

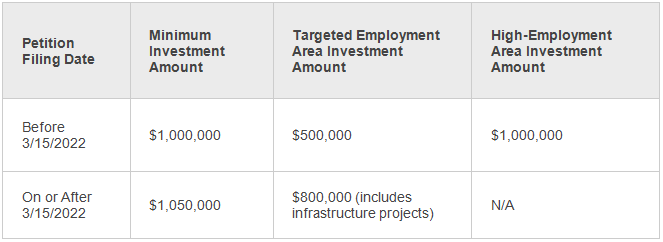

The minimum investment amounts by filing date and investment location are:

Future adjustments will be tied to inflation using the change in the Consumer Price Index for All Urban Consumers (CPI-U) from March 15, 2022, to the date of adjustment. These adjustments will occur every five years, with the first such adjustment effective for petitions filed on or after Jan. 1, 2027.

A targeted employment area can be, at the time of investment, either:

- A rural area; or

- An area that has experienced high unemployment (defined as at least 150% of the national average unemployment rate).

A rural area is any area other than an area within a metropolitan statistical area (MSA) (as designated by the Office of Management and Budget) or within the outer boundary of any city or town having a population of 20,000 or more according to the most recent decennial census of the United States.

A high-unemployment area consists of the census tract or contiguous census tracts in which the new commercial enterprise is principally doing business, which may include any or all directly adjacent census tracts, if the weighted average unemployment for the specified area based on the labor force employment measure for each tract is 150% of the national unemployment average.

Regional center investors may choose to invest in a new commercial enterprise engaged in an infrastructure project. An infrastructure project is a capital investment project in a filed or approved business plan, which is administered by a governmental entity (such as a Federal, State, or local agency or authority) that is the job-creating entity contracting with a regional center or new commercial enterprise to receive capital investment under the regional center program from alien investors or the new commercial enterprise as financing for maintaining, improving, or constructing a public works project of these set-aside visas that go unused are held in the same set-aside category for one more fiscal year. After the second fiscal year, any remaining unused immigrant visas in these set-aside categories are released to the unreserved EB-5 immigrant visa numbers during the third fiscal year.

For the most current information and detailed requirements, please refer to the U.S. Citizenship and Immigration Services website:

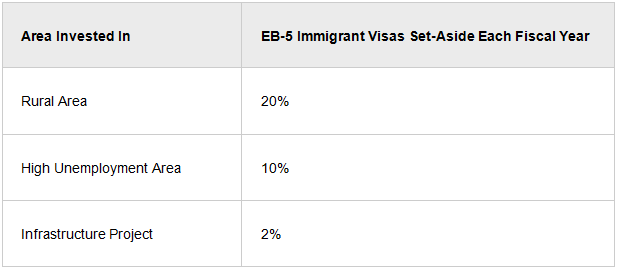

The EB-5 Reform and Integrity Act created new EB-5 immigrant visa set-asides for qualified immigrant investors. Each fiscal year, a certain percentage of EB-5 immigrant visas are available to qualified immigrants who invest in specific areas:

Any of these set-aside visas that go unused are held in the same set-aside category for one more fiscal year. After the second fiscal year, any remaining unused immigrant visas in these set-aside categories are released to the unreserved EB-5 immigrant visa numbers during the third fiscal year.

For detailed and up-to-date information on allocation requirements and guidelines, please visit the U.S. Citizenship and Immigration Services (USCIS) website:

Overview of the U.S. EB-5 Immigrant Investor Market in 2024

The EB-5 Immigrant Investor Program not only offers investment opportunities but also serves as a significant step toward realizing the American Dream for many individuals. Through this program, international investors contribute to the U.S. economy while gaining the benefit of becoming lawful residents.

The EB-5 Program focuses on improving areas with high unemployment rates and economically disadvantaged regions in the U.S. Foreign investment funds help drive economic development in these areas.

In return, foreign investors who invest in U.S. businesses receive Green Cards, granting them permanent residency and the opportunity to become U.S. citizens. EB-5 visa holders can live and work permanently in the U.S. with their families, including spouses and unmarried children under 21.Top of FormBottom of Form

The EB-5 Immigrant Investor Program not only offers investment opportunities but also serves as a significant step toward realizing the American Dream for many individuals. Through this program, international investors contribute to the U.S. economy while gaining the benefit of becoming lawful residents.

The EB-5 Program focuses on improving areas with high unemployment rates and economically disadvantaged regions in the U.S. Foreign investment funds help drive economic development in these areas.

In return, foreign investors who invest in U.S. businesses receive Green Cards, granting them permanent residency and the opportunity to become U.S. citizens. EB-5 visa holders can live and work permanently in the U.S. with their families, including spouses and unmarried children under 21.Top of FormBottom of Form

Investors can choose between two options: direct investment or investment through a regional center.

Direct investment requires opening a new company or acquiring an existing business, with a minimum investment of $1.05 million (or $800,000 if investing in a Targeted Employment Area – TEA), and creating at least 10 full-time jobs for U.S. workers. This is an active form of investment.

In contrast, investment through a regional center is a passive investment option, where investors are not required to directly manage the business. The minimum investment is $800,000 in a Targeted Employment Area (TEA), and the regional center handles project management and job creation.

We hope the information provided in this article has given you a clearer understanding of the EB-5 Immigrant Investor Program.